As the accounting industry continues to transform, young accountants are faced with an array of opportunities and challenges that shape their career trajectory. The rise of technology, changing regulations, and the shift towards more specialized roles have altered the landscape for new entrants into the profession. In fact, a recent survey found that over 60% of young accountants are looking to specialize in niche areas such as forensic accounting, tax advisory, or sustainability reporting, signaling a move away from traditional accounting roles. This new era of accounting is all about choice – the chance to tailor one’s career to personal strengths, interests, and the evolving demands of the business world.

The Changing Face of the Accounting Profession

Gone are the days when accounting was solely about number-crunching and bookkeeping. Today’s accountants are seen as business advisors, tech-savvy professionals, and data analysts. The integration of Artificial Intelligence (AI) and automation tools has led to an estimated 40% reduction in the number of basic accounting tasks that once consumed much of an accountant’s time. This has created an exciting environment for young professionals, who now have the freedom to focus on more strategic and value-added activities, such as financial forecasting, advising on tax strategies, and implementing financial technology solutions.

In addition, over 70% of accounting firms now offer flexible work arrangements, including remote work, part-time positions, and project-based roles, making it easier for young accountants to achieve a work-life balance. This flexibility allows them to choose roles that fit not only their career ambitions but also their personal lifestyle preferences.

Specialization vs. Generalization: Which Path to Take?

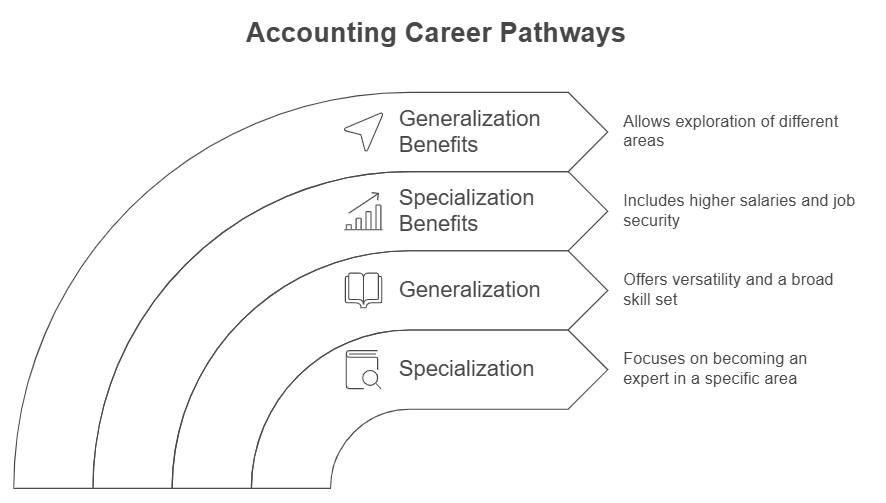

One of the most significant decisions young accountants face is whether to specialize in a particular field or to remain in a more general accounting role. According to a study by the American Institute of CPAs (AICPA), nearly 50% of millennials prefer to work in specialized fields, with corporate finance, auditing, and tax planning being the top choices.

Specialization offers several advantages. First, it enables accountants to become experts in a specific area, which can lead to higher salaries and more job security. For instance, forensic accountants – who specialize in investigating financial discrepancies – report an average salary increase of 20-30% compared to general accountants. Additionally, specialized knowledge can help accountants become trusted advisors in high-demand sectors, such as health care, real estate, or tech.

On the other hand, a generalist approach offers versatility, allowing young accountants to explore different areas and build a broad skill set. This can be particularly appealing for those who are still figuring out where their true passions lie within the field of accounting.

The Role of Technology and Automation

Technology has become a central theme in the world of accounting, and for young accountants, it presents both an opportunity and a challenge. 60% of accounting professionals report that they now rely on advanced software for tasks such as tax preparation, financial reporting, and audit procedures. Young accountants entering the workforce today are expected to have a high level of proficiency in these tools, and many firms prioritize candidates with skills in software like QuickBooks, Xero, and enterprise resource planning (ERP) systems.

Moreover, automation has led to the creation of new roles in the accounting field. 40% of accounting firms are investing heavily in AI and data analytics, creating a need for professionals who can bridge the gap between technology and traditional accounting practices. For young accountants, this offers an exciting opportunity to blend accounting with emerging fields such as data science and business intelligence, areas that were virtually non-existent just a few years ago.

Continuous Learning: A Key to Success

In today’s fast-paced world, the key to staying competitive is continuous learning. The accounting profession is constantly evolving, and young accountants must commit to ongoing education to stay ahead. According to a recent report, over 75% of young accountants participate in professional development courses and certification programs beyond their formal education. Obtaining certifications like Certified Public Accountant (CPA), Chartered Accountant (CA), or Certified Management Accountant (CMA) is becoming more common, as these credentials enhance career prospects and provide greater job security.

Moreover, many young accountants are taking advantage of online courses and webinars to stay updated on new technologies, regulatory changes, and industry trends. The flexibility of online learning means that they can easily integrate these courses into their busy lives, providing them with a competitive edge in an increasingly tech-driven profession.

Networking and Mentorship: Building a Strong Foundation

For young accountants, networking and mentorship are invaluable resources. According to a survey conducted by the National Association of Accountants, 65% of young professionals said that having a mentor in the field helped them navigate their early careers. Networking events, both in-person and virtual, provide opportunities to connect with experienced accountants and potential employers, while mentors offer guidance, career advice, and insight into how to handle challenges and seize opportunities.

Many accounting firms and professional organizations also offer mentorship programs, where seasoned professionals guide new accountants through the transition from education to the workplace. These relationships can prove crucial, especially for young accountants just starting to make decisions about their career path.

Conclusion

The accounting profession is undergoing significant changes, and young accountants today are in a unique position to shape their own careers. With the rise of technology, the demand for specialized skills, and the ability to work flexibly, there has never been a better time to explore the different paths available in the field. By focusing on continuous learning, embracing technology, and seeking out mentorship and networking opportunities, young accountants can create fulfilling and dynamic careers that align with their personal and professional goals.

The accounting profession is no longer a one-size-fits-all career path – it’s an exciting world of possibilities, and young accountants have the freedom to choose their own adventure.